Top 10 Safe & Reliable Online Loan Apps in the Philippines (2026)

These days, getting a loan is as easy as ordering milk tea. With just a few taps on your phone, you can already receive cash for emergencies, bills, or even a sudden shopping need.

But here’s the thing — not all loan apps are safe. Some charge crazy interest rates, others bombard your contacts with harassment messages. Kaya ingat tayo mga kadiginatic. The smartest move? Only borrow from SEC-registered, legit, and trusted apps. If possible, go for online loan apps with low interest para hindi mabigat ang bayad every month. At siguraduhin ding online loan app SEC registered para protektado ka under Philippine law.

In this guide, I’ll share my Top 10 safest and most reliable online loan apps for 2025 — based on my own experience, plus feedback from friends, relatives, and real borrowers online.

Table of Contents

How to Spot a Legit Online Loan App

Before you tap that “Apply Now” button, always check these if that Online Loan App Legit:

- SEC Registration – This is non-negotiable. All legal lending companies in the Philippines must be registered with the Securities and Exchange Commission (SEC). Kung wala sa listahan, wag mo na ituloy.

- Transparent Fees – Interest, charges, and repayment schedule must be clear from the start. No hidden charges na ikagugulat mo pag due date na.

- Data Privacy – They should protect your personal information and not request unnecessary app permissions.

- Good Customer Support – It’s best if they have real people you can talk to, not just canned responses.

- No Harassment Policy – Legit lenders follow proper and legal collection practices — hindi ka ipapahiya sa contacts mo.

Top 10 Legit Online Loan App in the Philippines(2025)

Before we get started, I want to be clear: these are legit and trusted online loan app legit— handpicked through my own research and experience. Lahat ng nasa list na ‘to ay SEC-registered, safe gamitin, at subok na ng maraming Pinoy borrowers.

I also considered online loan apps with low interest so you can save on charges, and made sure each platform is an online loan app SEC registered for your safety.

1. BillEase

Popular for installment shopping but also offers personal loans with flexible terms.

- Loan Amount: Up to ₱40,000

- Interest: 3–5% monthly

- Pros: Flexible payment plans, no credit card needed

- Cons: Lower initial loan for first-timers

- Best For: Budget-conscious borrowers who want clear repayment terms.

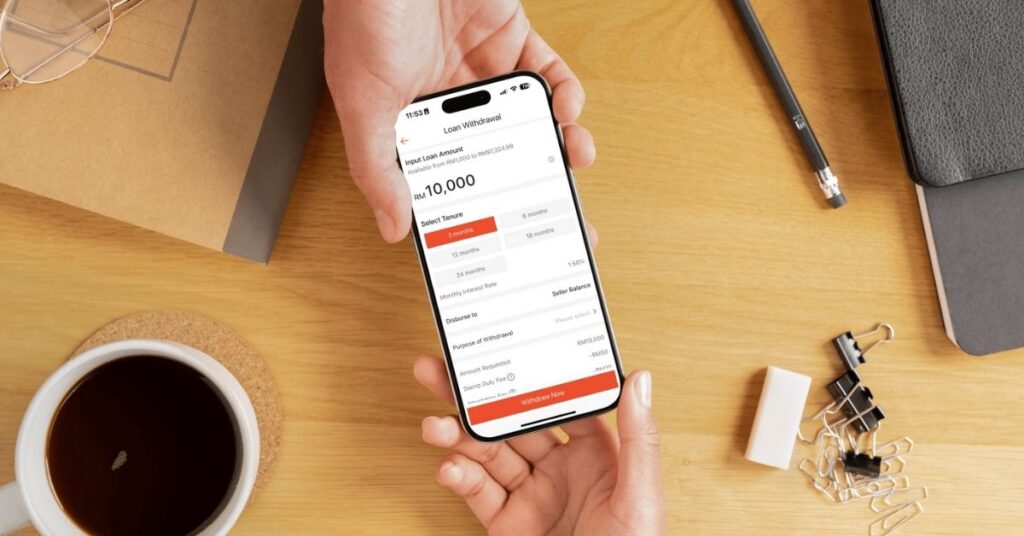

2. Home Credit

Known for appliance and gadget installment plans, Home Credit now also offers personal cash loans.

- Loan Amount: Based on credit score

- Interest: Less than 10% monthly

- Pros: Established brand, nationwide presence

- Cons: Higher rates if you have a low credit score

- Best For: Borrowers with existing credit history.

3. SLoan & Shopee PayLater

Perfect for frequent Shopee buyers. Aside from shopping, you can also borrow cash directly from the app.

- Loan Amount: Up to ₱100,000

- Interest: ~4.95% monthly

- Pros: Integrated with Shopee, quick application

- Cons: Only available to Shopee users with good records

- Best For: Frequent online shoppers who need extra funds.

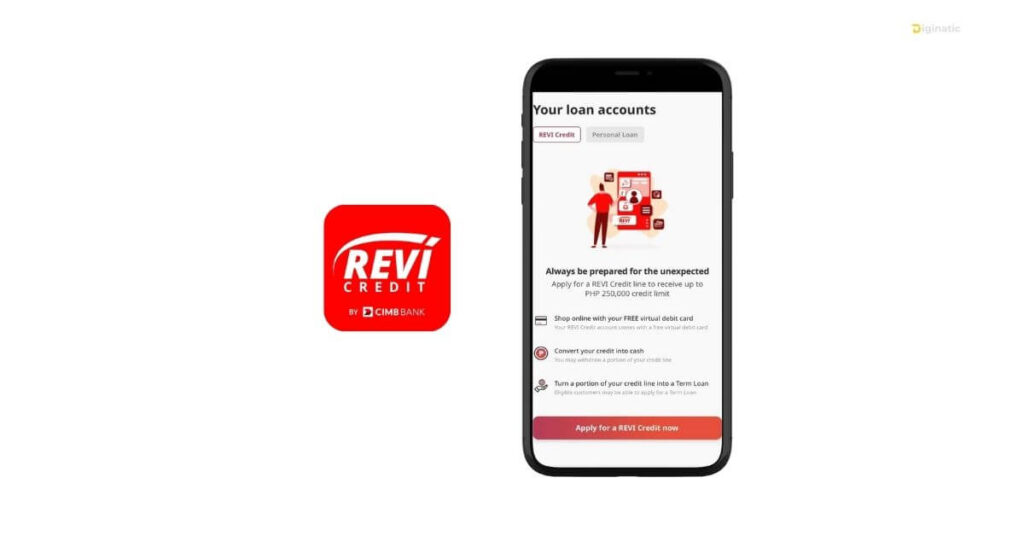

4. CIMB Bank – REVI Credit / Personal Loan

Need a more comprehensive digital lending option? Try CIMB Bank’s REVI Credit or Personal Loan—accessible through the OCTO app.

- Loan Amount: ₱30,000–₱1,000,000

- Interest: 1.12%–1.95% monthly (REVI offers ~1% for some users)

- Why Borrowers Like It: Fast approvals, flexible loan types (revolving or term), and a trusted bank behind it

- Keep in Mind: You must be a CIMB account holder; fees may apply; app performance and effective cost can vary

- Best For: Those who want serious loan amounts with modern digital banking features

5. GLoan & GCredit (GCash)

If you’re active in GCash, this is one of the most convenient online loan app legit options.

- Loan Amount: Up to ₱125,000

- Interest: As low as 1.59% monthly

- Pros: Direct to GCash wallet, BSP-regulated

- Cons: Requires high GScore for bigger loans

- Best For: GCash power users.

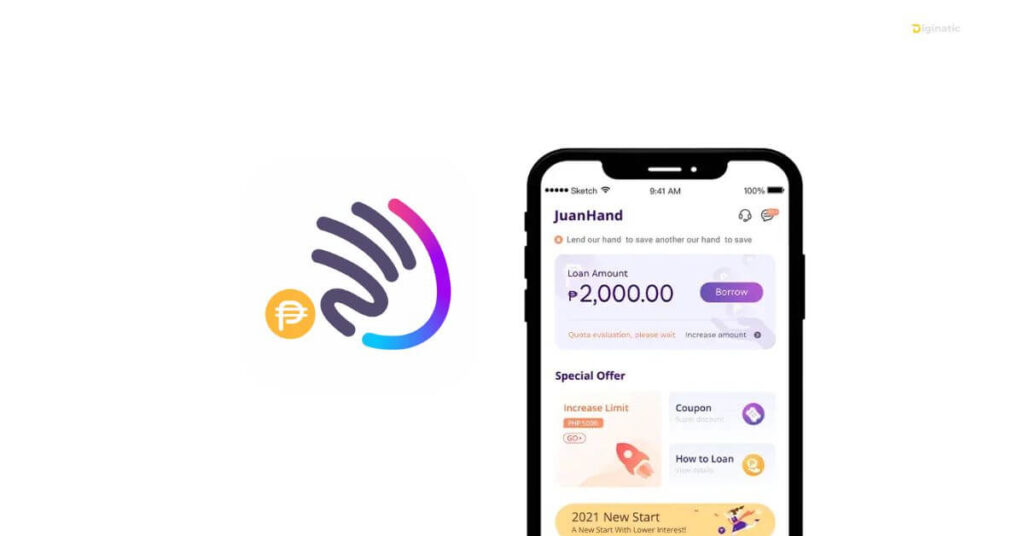

6. JuanHand

A crowd favorite for beginners in online lending. The approval process is quick, and the app is easy to use even for first-timers.

- Loan Amount: Up to ₱50,000

- Terms: 30 days to 4 months

- Interest: Based on credit profile

- Pros: Fast release, beginner-friendly

- Cons: Small starting limit for new users

- Best For: First-time borrowers na gusto ng mabilis at legit option.

7. JuanCash

Another SEC-registered online loan app Philippines that’s gaining popularity for its fast process and fair interest.

- Loan Amount: ₱2,000 – ₱50,000

- Terms: 30–90 days

- Pros: Quick approval, low document requirements

- Cons: Short repayment terms

- Best For: Emergency borrowing.

8. Mabilis Cash

True to its name, mabilis mag-approve and release ng loan once your documents are ready.

- Loan Amount: ₱2,000 – ₱20,000

- Interest: ~3.5% monthly

- Pros: Fast disbursement, simple requirements

- Cons: Limited loan amount for repeat borrowers

- Best For: Short-term financial needs.

9. Tala Philippines

A pioneer in mobile lending apps in the country.

- Loan Amount: ₱1,000 – ₱25,000

- Terms: 21–30 days

- Pros: Easy sign-up, no collateral

- Cons: Higher interest for first loans

- Best For: First-time borrowers with no credit history.

10. Cashalo

Flexible personal and installment loans with a user-friendly app.

- Loan Amount: ₱2,000 – ₱50,000

- Interest: 3–4% monthly

- Pros: Flexible repayment terms, SEC-registered

- Cons: Higher rates if repayment is late

- Best For: Shoppers and small business owners.

Quick Comparison Table

| Online Loan App | Loan Amount | Interest (Monthly) | Terms | Best For |

|---|---|---|---|---|

| JuanHand | Up to ₱50,000 | Based on credit profile | 30 days – 4 months | First-time borrowers |

| Home Credit | Based on credit score | < 10% | Flexible | With credit history |

| SLoan & Shopee PayLater | Up to ₱100,000 | ~4.95% | Flexible | Shopee users |

| CIMB Bank (REVI Credit / Personal Loan) | Up to ₱1,000,000 | ~1.12%–1.95% monthly | Flexible (revolving or term) | Tech-savvy borrowers |

| GLoan & GCredit (GCash) | Up to ₱125,000 | 1.59% | Flexible | GCash users |

| BillEase | Up to ₱40,000 | 3–5% | Flexible | Installment shopping |

| JuanCash | ₱2,000 – ₱50,000 | Varies | 30–90 days | Emergencies |

| Mabilis Cash | ₱2,000 – ₱20,000 | ~3.5% | Short-term | Quick loans |

| Tala Philippines | ₱1,000 – ₱25,000 | Varies | 21–30 days | No credit history |

| Cashalo | ₱2,000 – ₱50,000 | 3–4% | Flexible | Shoppers & SMEs |

Conclusion

Online loan apps in the Philippines offer convenience, speed, and accessibility — especially when emergencies strike. From well-known platforms like GLoan, BillEase, and JuanHand to other legit, SEC-registered lenders, there’s no shortage of options for quick financial assistance.

However, every loan comes with a responsibility. Interest rates, payment terms, and penalties can add up if not managed properly. Kaya bago mag-apply, assess your needs, compare your options, and make sure kaya mong bayaran on time.

Read More About Budgeting Tips Philippines: Ultimate Guide for Tech Pros (2025)

Remember: The goal of borrowing is to solve a problem, not to create a bigger one. A well-chosen loan can help you bridge short-term gaps, but wise spending and proper budgeting are still your best tools to stay financially healthy.