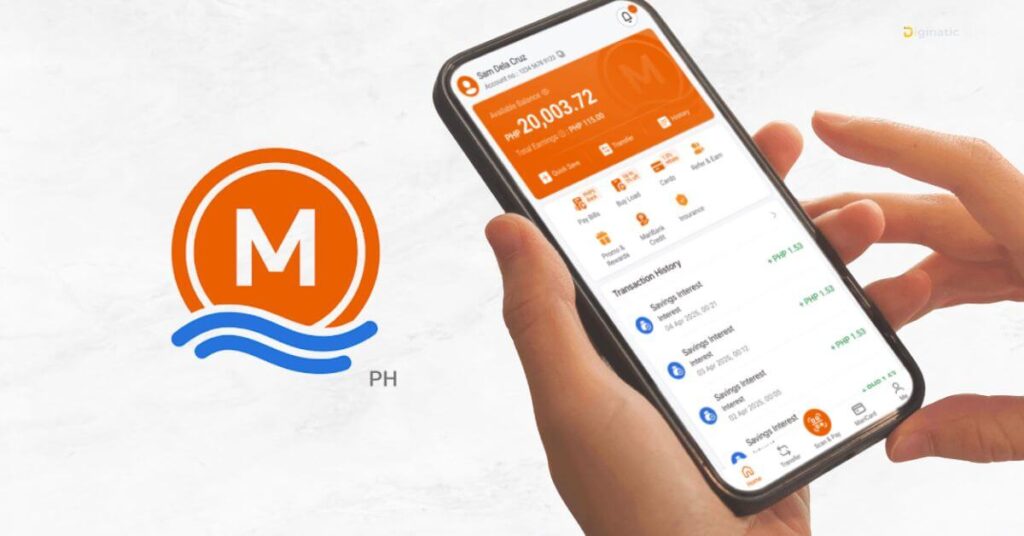

MariBank (SeaBank Rebrand) Review: A Honest Look at This Digital Bank for Filipinos

More Filipinos now is turning to mobile-first banks for convenience, better savings rates, and lower fees. I have many apps on my phone: PNB, Maya, CIMB, MayBank and more. Now I recently installed MariBank for it is one of the newest players making headlines. Naintriga ako kaya share ko na sa inyo ang masasabi ko kahit new user lang ako.

By the way, MariBank Philippines, Inc. is the rebranded version of SeaBank Philippines kaya kung ikaw ay may account na sa Seabank, don’t worry, new name but it is still the same SeaBank you have known.

In this article, let’s discuss it’s features, and perks you should know before opening an account o kahit may account ka na. Dagdag information ito para you can get the most out of it.

MariBank Review & Features

Una kung nakilala si SeaBank sa platform ni Shopee. Hesitant ako sa pag open ng account since i had many digital banks sa phone ko and savings lang naman talaga sadya ko na accessible sa phone. Pero ito yung mga key features ni Maribank kaya na enticed akong mag-open ng account kaya gumawa din ako ng MariBank Review na makatulong din sayo:

Mobile App Banking – Di man ito bago sakin kasi nga I had a several mobile banking app sa phone ko but still, isa pa rin ito sa key na napa open ako sa MariBank. Just one valid ID away. Kailangan na ang ni-input mo na personal information ay same sa makikita sa valid ID mo. Example, kung sa valid ID mo is yung pang single mo pa na apelyido kahit kakasal mo palang, yun parin ilagay mo.

MariBank Interest Rate: High-Interest Savings – 3.5% per annual ang interest rate ni MariBank at ang kagandahan ay credited ito daily kaya kitang kita mo talaga ang pagtubo ng pera mo araw-araw. They also an update na as of October 1, 2025, account balances that are above PHP 1,000,000 will earn 4% p.a. interest rate. Bongga diba?

Free Transfers – Nag aavail ako ng PESONet transaction for zero transfer fees. Kahit PHP 15 na transfer fee, sayang na din diba na pwede mo na sanang ilagay sa savings? Kaya maging wais katulad ko.

MariBank Debit Card & Cashback – Ito talaga yung pinakanagustuhan ko ni Maribank. Imagine, first deposit mo palang with a minimum of PHP 100 only, may PHP 15 kang ma receive as cash bonus the following day. If you keep that same amount in your account for 6 more days, they will give you additional PHP 15 bonus for a total of PHP 30 sa account mo. They also have a physical debit card na pwede mo rin makuha for free kapag naabot mo ang mga requirements nila na makikita mo sa notifications sa mobile app mo. Available din ang mga cashback rewards for purchases you made. Diba, ang laking tipid!

No Maintaining Balance – Accounts can stay active without minimum deposit requirements. Wala kang babayaran na penalty kung nagamit mo lahat ng pera sa account mo.

Insured Deposits – Funds are protected by PDIC. Importante to dahil kahit magsara o malugi ang bangko, protektado ang pera mo.

Other Perks inside App

- Free 15 transfers weekly at nag rerefresh ito every Monday

- Kung mahilig ka mag check-out sa Shopee, up to 25% off ang discount when you pay through ShopeePay using MariBank as a source of funds.

- Up to 50% Maribank cashback perks when you pay bills using MariBank app every month.

- Up to 5% off using the Buy Load feature in the app.

- Get exclusive offers from their digital insurance.

- Referral rewards. Makaka earn ka ng cashback in every successful opening of an account ang friend mo. Kung gusto mo nang magstart to earn, sign up here.

Who is MariBank Best For?

MariBank is best suited for:

- First-time digital bank users na gusto yung simple, and no-maintenance savings account.

- Everyday spenders who like cashback perks from a debit card.

- Savers who want competitive daily interest credited to their account.

- Shopee users who may benefit using MariBank as mode of payment

Final Thoughts

If you’re looking for a straightforward digital bank with higher interest than traditional banks, MariBank is worth trying. Enjoy their cashback promos.